2020 Digital Therapeutics Predictions: Big 6

A year ago, we knew the digital therapeutics (DTx) industry was maturing as user adoption and related offerings were mushrooming and a consolidation in global investments after 3 years of almost 50% YOY growth.

A year ago, we knew the digital therapeutics (DTx) industry was maturing as user adoption and related offerings were mushrooming and a consolidation in global investments after 3 years of almost 50% YOY growth. As we enter a new decade, the rapid transition to an increasingly digital consumer health experience continues. I expect the integration of DTx into health plan and care delivery organization offerings as well as corporate wellness programs to continue its rapid climb. However, headwinds in the form of intense competition, demands for solid ROI metrics, clinical validation and user privacy concerns are also impacting the 2020 DTx forecast.

Energized by the J.P. Morgan Healthcare Conference last week and looking at the year ahead, I believe the digital therapeutics space will be driven forward – and in some cases challenged – by these big 6 digital therapeutics trends:

- A More Significant Pharma-DTx Footprint

- The Rise of Alternative Distribution Channels

- Rigorous ROI and VOI is a DTx Must-Have

- The Rise of Quality, Peer-Reviewed Data for DTx Acceptance

- Health Data Sharing Pitfalls and Protections

- A Shift from Point Solutions to Multi-Disease Platforms

1. A More Significant Pharma-DTx Footprint

Building on strong momentum established in 2019, more partnerships and alliances will boost pharma’s DTx footprint in 2020. My perspective is that these partnerships will be centered on pharma players licensing digital products and launching them as a unique asset, bundling DTx and existing drug products with overlapping indications as well as leveraging the quantitative insight that can be derived from the utilization of DTx. One application, I believe, will be tapping into DTx products that collect real-world data for post-market analysis of efficacy for drug, DTx or drug-DTx combinations.

DTx-pharma partnerships have tremendous upside. I foresee that pharma will increasingly turn to the DTx industry for the technical and logistical expertise and the marketing velocity capabilities needed to drive these solutions from concept to capitalization to commercialization. That said, the competitive threat from pharma is gaining traction and cannot be overlooked. Pharma companies developing their own DTx solutions or adjusting existing solutions to their needs, mainly via inlicensing and acquisitions, will be looking to bring industry talent on board to build their own presence in this lucrative space.

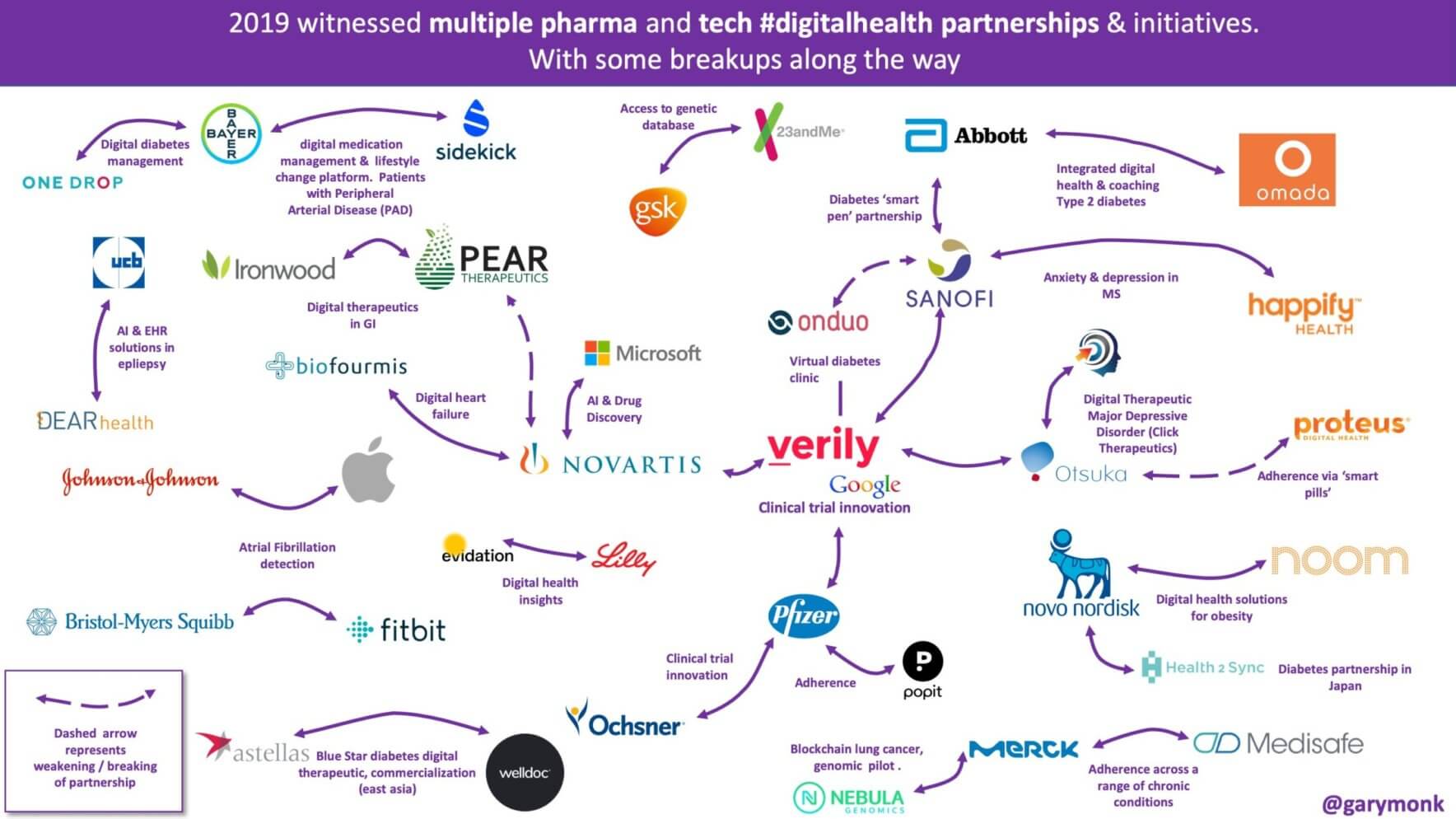

Glancing back at 2019, we see that pharma dove into the DTx market with several major deals, including: A Bayer-led US $40 million funding round of diabetes management company One Drop; global biopharma leader Sanofi partnering with digital mental health company Happify Health to develop a prescription digital therapeutics tool for treating depression in patients with multiple sclerosis; Novartis entering into a collaboration with digital therapeutics company Biofourmis, a commercial project for managing patients with heart failure.

These three deals alone point to a major factor in pharma’s push into DTx: Chronic disease. Chronic disease makes up a major portion of the total healthcare spend in the US and globally, and industry experts believe this segment will continue to drive the global digital therapeutics market valuation to more than US $9 billion by 2027. It’s my belief that pharma partnerships in 2020 will leverage DTx solutions to build state-of-the-art healthcare monitoring and delivery platforms that connect patients, payers, caregivers, and healthcare providers for chronic disease management.

Although the partnerships mentioned here came with their share of challenges, it’s important to realize the value these relationships bring to stakeholders while mitigating risk. A sign of the growing push toward building strategic partnerships was the first-ever Digital Therapeutics Strategic Partnership Summit held at the close of 2019 in Los Angeles. The event brought together all sides of the healthcare equation to collaborate on delivering value and an elevated standard of care to patients. With the growth of digital therapeutics becoming a prominent feature of the J.P. Morgan Healthcare Conference, this promises to be an exciting 2020 in digital health and innovation. I expect the integration of digital therapeutics in the provider setting and building out a reliable prescription pathway will further improve and scale as pharma refines their market access strategy to build on their existing provider relationships to distribute DTx as a new product category.

2. The Rise of Alternative Distribution Channels

In the coming months, I expect digital therapeutics companies will jump from consumer channels to alternative distribution channels as only a small sub-population of consumers with a diagnosed chronic condition are willing to pay out-of-pocket. Expect a significant transition away from direct-to-consumer models in favor of provider, health plan, pharma and employer channels.

Consumer apps such as Headspace, Calm and Practo will broaden their field of influence from the broader digital health and wellbeing markets to seek out the more lucrative, less-cluttered DTx space. This space, as it matures, will build its success on higher levels of evidence through well-designed clinical trials demonstrating improved outcomes along with reduced spend.

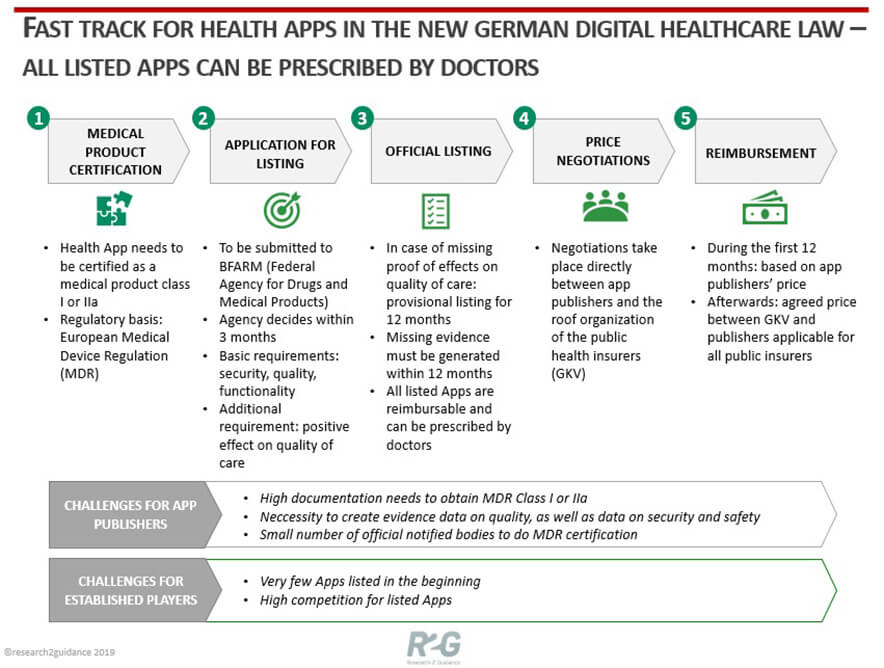

For example, the German government recently passed a law allowing digital therapy solutions to be prescribed by doctors [source of graphic below], which opens the door for this adoption pathway. The new legislation aligns with the recent regulatory approach in the US, where the FDA has introduced a pathway to approve apps that have substantial evidence showing clinical benefits.

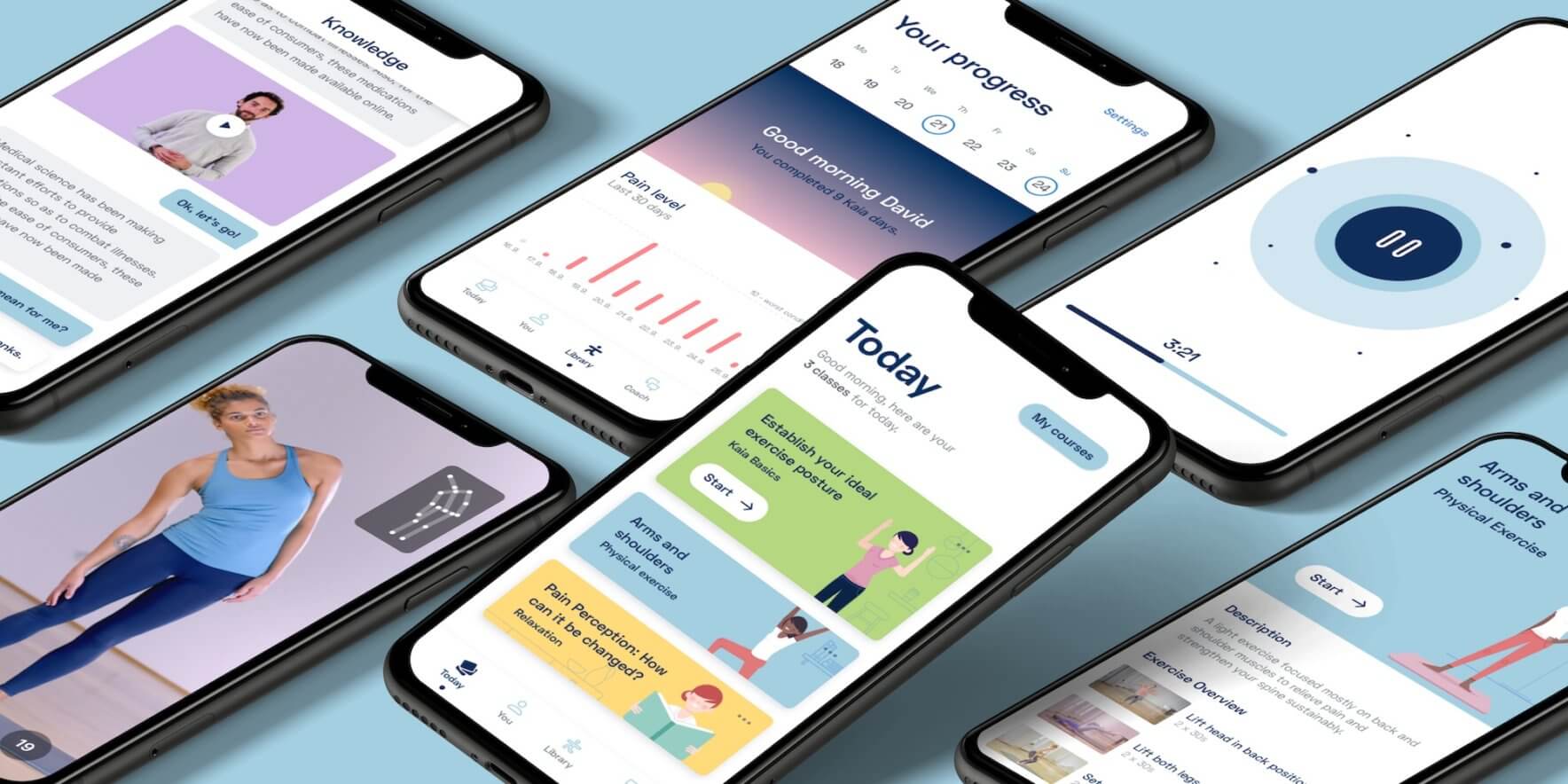

In 2017, Pear Therapeutics became the first company to achieve “digital therapeutic” approval by the FDA for its addiction treatment app. Since then, Oleena, the Voluntis mobile app for oncology patients and the Biovitals™ Analytics Engine have earned FDA clearance as digital therapeutics. Several other DTx apps are pursuing FDA clearance, including Kaia Health’s AI-powered back pain app with personal coaching and Akili Interactive, which has filed for FDA approval of computer games designed to treat ADHD and autism spectrum disorder.

This year, count on major US insurance providers to see increasing value in the benefits of advanced DTx solutions. Look for a significant increase in approvals similar to Renovia’s Pelvic Digital Therapeutic for the strengthening of pelvic floor muscles and Biofourmis’ BiovitalsHF mobile app for recently discharged heart failure patients. I foresee another 5 to 10 DTx apps gaining FDA clearance in 2020.

3. Rigorous ROI and VOI is a DTx Must-Have

Successful DTx companies in 2020 will live and die by ROI and seal the deal with VOI.

As competition heats up in the DTx space, the importance of demonstrating return on investment (ROI) is a given. However, DTx solutions must be willing and able to demonstrate both return on investment (ROI) and value on investment (VOI) to drive adoption, differentiation and market share.

DTx companies that strategically approach ROI and VOI value propositions for DTx solutions will be able to demonstrate that they are more cost-effective, complementary offerings to traditional solutions such as in-clinic physical therapy sessions and general health digital solutions. I predict that therapeutics offerings able to collect and quantify information about outcomes in real-world settings – combined with more intangible value drivers – will achieve greater success in 2020. For example, can a DTx demonstrate that per employee/member per month (PMPM) spend goes down after introducing a chronic disease management DTx, proving that the DTx is a direct (cheaper) substitute compared to the standard of care in certain cases or for certain population subsets?

Demonstrating value for a DTx solely based on ROI can be misleading and difficult. VOI is more abstract than ROI, but with real-world impact that can make or break a digital therapeutic, providing differentiation and added value. As Dean Griffiths of Energy Fusion describes it, “…the positive qualitative effect on the organizational culture cannot be understated, with direct impact on talent and team spirit as well as other variables that are incremental to the quantitative benefits measured.”

VOI is usually “measured” in terms of increased productivity, motivation and engagement with wellness programs along with decreased absenteeism and presenteeism. The ability to hire and retain top talent is also an abstract – but very real measure of DTx success. For a closer look at the role of VOI and the value of taking a broader, more holistic view of employee health, read the section on the worth of digital health in this Digital Health Guidebook.

4. The Rise of Quality, Peer-Reviewed Data for DTx Acceptance

DTx products rely on best practices in design, clinical validation, usability and data security. These products are reviewed and cleared or approved by regulatory bodies in order to support product claims regarding risk, efficacy and intended use.

Published randomized control trials (RCTs) are already a prerequisite for DTx companies seeking reimbursement and pursuing FDA and/or European MDR-compliant device clearance. And the availability of published, peer-reviewed data supporting DTx solutions will be a key to success in 2020. Since 2017, the FDA has seen companies in the digital therapeutic space enter the De Novo pathway based on previous clinical data and achieving clearance.

Major industry groups including the Digital Health Coalition, Digital Therapeutics Alliance, and Digital Medicine Society (DiMe) have established standards for what constitutes digital therapeutics. These efforts have resulted in increasing pressure for DTx solutions to demonstrate clinically meaningful outcomes along with adhering to a well-received guide on best practices for digital therapeutics. This is in addition to recent FDA guidance that helps to identify the adequate risk class based on the claims that are made by a DTx solution, providing guidance and clarification on which digital health products fall under what level of regulatory oversight.

In 2020, peer-reviewed clinical validation will be required just to start the DTx conversation. Without it, health-related apps will be relegated to the broader, saturated and highly competitive consumer mobile health and fitness app market. Clinical validation is already required before payers bring on digital therapeutic solutions. In the new year, look for most health plan, benefits plans or employer offerings to also require a high degree of clinical validation before even considering onboarding a DTx.

5. Health Data Sharing Promise and Pitfalls

The value of data generated by DTx solutions is growing exponentially as millions of users engaged across thousands of platforms and apps provide a rich source of health information. This powerful collection of health data is critical to providers, researchers and product developers looking to improve outcomes, support therapies with higher levels of data and drive adoption.

I predict that a key driver of pharma’s move to increase its 2020 footprint will be access to huge volumes of real-world data through deals that drive vertical integration. This strategy will impact the payer space as well, so keep your eyes open for more blockbuster vertical integration deals such as the CVS Caremark-Aetna merger, which offers a powerful opportunity to capitalize on the availability of big data.

However, DTx companies and their business customers must be aware of the heightened reluctance among consumers to share data in 2020. This is a significant market risk that could interfere with the long-term upward trend in DTx adoption. In the broader digital health space, for example, Google’s recent acquisition of Fitbit caused some users to ditch their devices and seek alternatives based on inherent distrust of Google data privacy practices. Apple’s communication at its WWDC in June 2019 underlines this trend and takes advantage of the narrative against its arch enemy. Look for data privacy scenarios such as this play out more than once in 2020 in the DTx space.

Health data privacy policies, therefore, must keep up with technology. The latest industry trends indicate the willingness to share health data has declined over time, even for sharing with physicians. In fact, physicians experienced the largest year-over-year losses in consumer willingness to share health data. Technology companies sit at the bottom of this list, with one in ten respondents willing to share health data with these companies. Health tech companies fare slightly better, as 23% of respondents are willing to share data with them.

6. A Shift from Point Solutions to Multi-Disease Platforms

As the push to lower healthcare costs and improve outcomes continues, health plans and employers will look to add an increasing number of DTx solutions. Furthermore, chronic conditions such as musculoskeletal (MSK) pain or chronic obstructive pulmonary disease (COPD) rarely present as a single problem but come in conjunction with a set of comorbidities, and this creates its own set of challenges. Today, it’s not unusual for employers to have as many as 5 to 10 different non-integrative “point solutions” or apps in an employee wellness program to address various patient needs.

Moving into 2020, I expect this point solution fatigue to result in businesses and wellness and benefits plan managers looking for ways to consolidate, thus strengthening the third-party benefits provider market, payer-internal care navigation solutions as well as navigation platforms such as Virgin Pulse, CoreHealthTechnologies and Accolade. I anticipate that companies treating a single condition will join forces with other DTx point solution providers to expand their offering for a more integrated, holistic healthcare experience. I also expect DTx companies to further integrate their offering on the provider-facing side, e.g. integrating with chronic disease management programs. That allows leveraging the existing relationship between case managers or health coaches and patients to offer DTx solutions through this trusted relationship, improve engagement and outcomes and thus better account for the individual situation each user is facing, such as comorbidities.

This emerging DTx consolidation push will see benefit plans and payers offering a broad range of clinical programs as consolidated platform solutions to support chronic disease management in areas where they will have the most impact. This includes conditions such as diabetes, COPD, and MSK health along with behavioral health. This platform consolidation will be combined with integration across healthcare delivery channels, including the integration of DTx with telemedicine and precision prescription providers.

Where do we go from here?

What do you believe is in store for digital therapeutics in 2020? Let me know your thoughts in the comments below or when we meet next time.